Mexico CFDI

e-Invoicing Mexico via cbs e-world.cloud

With cbs e-world.cloud, companies can efficiently manage complex requirements to meet time sensitive deadlines and avoid costly penalties. cbs has developed a structured, automated, comprehensive solution for handling Mexico’s regulatory structure. Leveraging the SAP framework as a solution that helps businesses with compliance changes in a simplified and sustainable way.

This is your one stop shop!

Access in 4 easy steps

-

Integration with SAP’s eDocument Cockpit

- Seamless SAP native user friendly integration

-

Centralized XML Mapping in cbs e-world.cloud

- XML mappings are done in the cbs e-world.cloud

- Local mappings done in SAP (i.e., document types)

-

PAC Communication Managed by cbs

- cbs manages the connection/communication with the PAC (Detecno)

-

Technical Setup – Combination of cbs Transports and SAP Notes

- Implementation is simple and ensures proper alignment with SAT’s requirements.

Mexico CFDI (Comprobantes Fiscales Digitales por Internet)

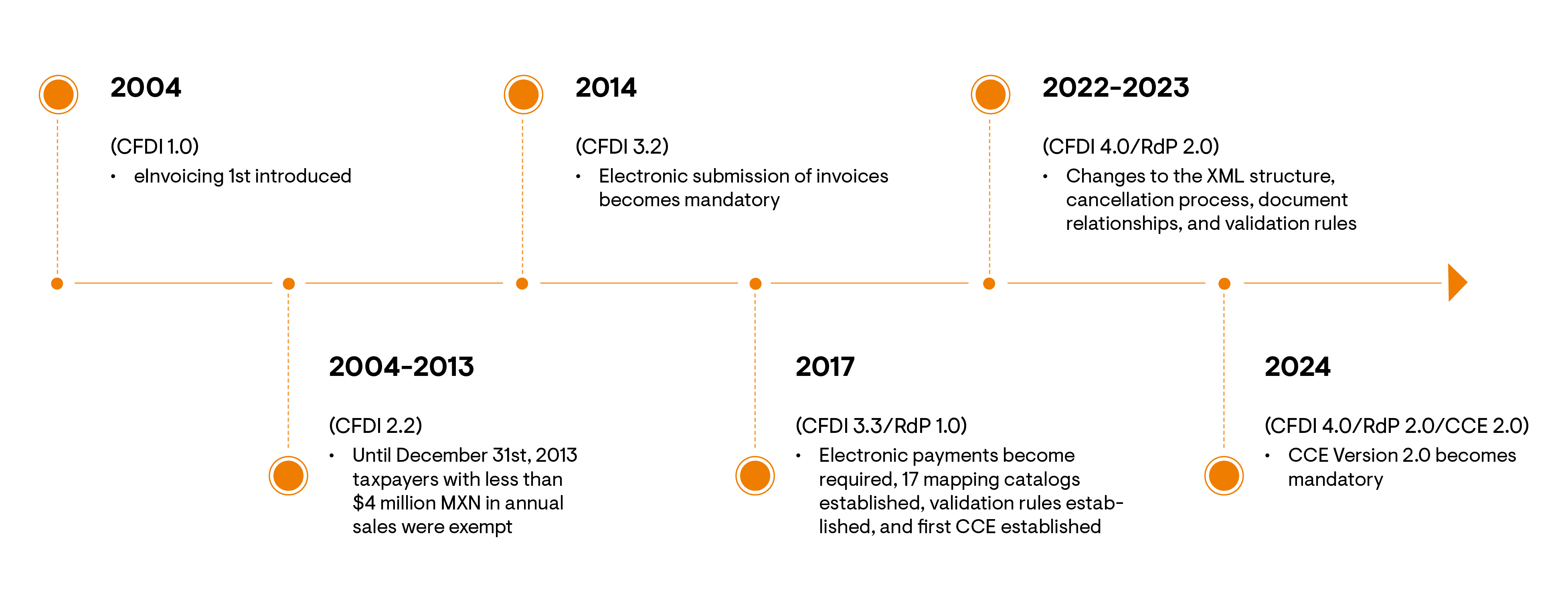

Timeline of key events

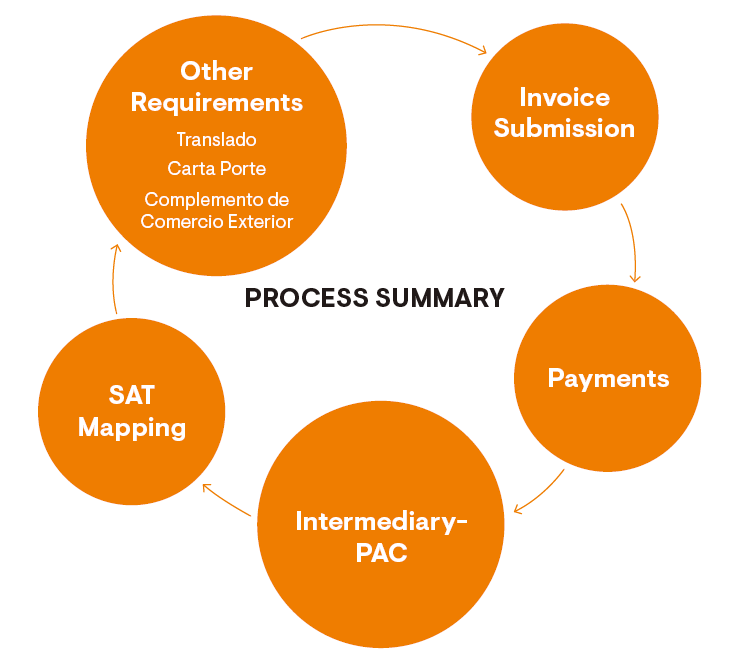

Mexico’s CFDI Process for e-Invoicing

In Mexico, the e-Invoicing process is highly regulated and requires businesses to submit all invoices and payments to SAT, ensuring tax compliance.

- Upon creation of the invoice, it must be submitted within 72 hours

- With the exception of invoices paid at the time of issuance (PUE), 72-hour requirement also applies

- Serves as the intermediary between the sender and SAT

Contact us

We will be happy to assist you personally if you would like

a detailed consultation. Please contact us directly:

Worldwide e-invoicing solutions for 30+ countries many more on future schedule

Looking for e-invoicing solutions beyond Mexico? Explore our comprehensive services for 30+ countries worldwide, with even more on the way. Click below to discover how we can support your global compliance needs.